Take advantage with Balance Transfer

Enjoy lower interest charges and repayment/payment when you consolidate your credit card/-i outstanding balance from other banks to your AmBank/AmBank Islamic Credit Card/-i

![]()

Competitive rate

Attractive rate as low as 4.88% with no upfront fees

![]()

Document-free

No supporting documents required

![]()

Flexible terms

Flexible repayment/payment period up to 60 months

(Tenure: 6, 12, 24, 36, 48 or 60 months)

Savings Made Easy

*Assuming the interest/profit charged on the outstanding balances is 18% p.a. Terms and conditions apply.

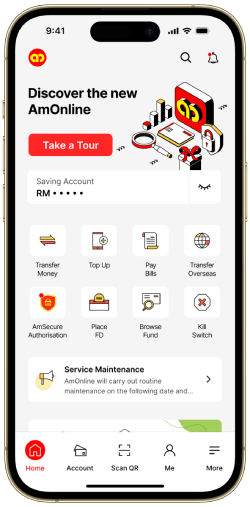

How to Apply Online

STEP

1

Launch the AmOnline App

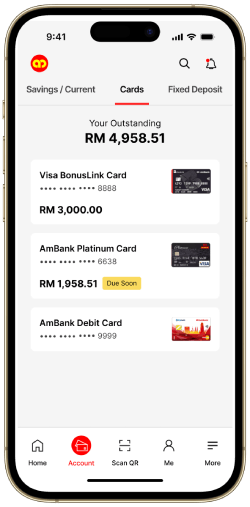

STEP

2

Tap "Accounts" and select your preferred Credit Card/-i

STEP

3

Tap "Apply Balance Transfer" and follow the steps. You will receive an SMS or e-mail notification for your application.

Not on AmOnline? Get started easily.

Download the AmOnline mobile app via Google Play Store, App Store or Huawei AppGallery.

Register for AmOnline by following the steps.

Tap "Accounts" and select your preferred Credit Card/-i.

Tap "Apply Balance Transfer" and follow the steps.

More Ways to Apply

![]()

Visit Our Branch

Find your nearest branch and ask us about Balance Transfer.

![]()

Give Us a Call

Reach us at 03-2178 8888 (Monday-Sunday), 7.00am to 11.00pm to ask us about Balance Transfer.

![]()

Fill in your details

Fill in and submit your details in our form

Fill in your information to apply for Balance Transfer

Your Full Name (e.g. Ahmad Bin Ali)

Malaysian Mobile Number (eg. 0123456789)

Last 4 digits of AmBank Credit Card/-i

Frequently Asked Questions (FAQ)

1. What is Balance Transfer?

Balance Transfer allows you to transfer your Credit Card/Credit Card-i balances from other banks

or financial institutions to your AmBank Credit Card/AmBank Islamic Credit Card-i.

2. What is the minimum and maximum amount for a Balance Transfer application?

The minimum amount per application is RM1,000. The maximum amount is subject to the

available limit of your Credit Card/Credit Card-i, whichever is lower.

3. May I cancel or opt for early settlement for my Balance Transfer?

Yes, but take note the one-time interest rate/profit rate billed is not refundable for any circumstances whatsoever even if the Cardholder revokes his/her instruction as above and/or fails to make full payment/repayment. The one-time interest rate/management fee shall be debited to the Cardholder’s Card Account.

Do more with your AmBank Credit Card/-i!

QuickCash

Get cash from your available credit limit

AmFlexi-Plus

Convert your credit card outstanding balances into affordable instalment

AmFlexi-Pay

Convert your purchases into affordable instalments

Easy Payment Plan

Great shopping experience with interest/management fee-free monthly instalments

AmBonus Rewards Catalogue

Redeem your AmBonus Points for your favourite gadgets, shopping vouchers or air miles

Auto Balance Conversion

Pay off your outstanding balances at a lower interest/management fee of 13% p.a.

Don't have an AmBank Credit Card/-i?

Apply for one today to enjoy more exclusive rewards and privileges.