New and Renewed Annual Non- Motor General Insurance Based on gross amount, excluding Stamp Duty and Tax, and not eligible for non-motor cases with full/partial rebate | Reward via Cash Prizes or BonusLink Points Rounded to the nearest RM |

| Below RM100 | 10% Gross Written Premium |

| RM100 and above | 15% Gross Written Premium |

Note:

- Customers who apply via the AmOnline App or the AmBank Telesales team will receive Cash by default. The Cash will be directly credited into their AmBank or AmBank Islamic Current or Savings Account.

- For applications made through physical branches, customers can choose to receive either BonusLink Points or Cash as their reward.

Maximise the rebates you deserve

Campaign Period: 2 December 2025 – 31 March 2026

Apply via AmOnline App today

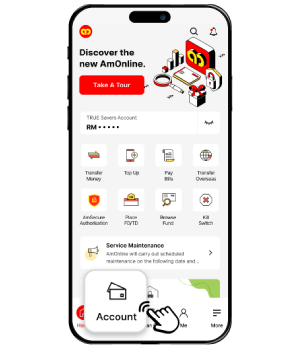

Step 1

Launch the AmOnline App and tap on ‘Accounts’

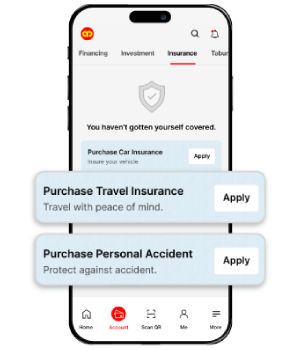

Step 2

Tap on ‘Travel Insurance’ or ‘Personal Accident’ to begin

Explore what fits your needs

Travel Insurance

Kurnia Travel Supreme

Enjoy worry-free travel with our extensive cover

Kurnia Travel Supreme

Get ready for your next travel adventure, anywhere in the world worry-free!

Personal Accident Insurance

Perfect Rider Plus

Enhance your motor insurance with personal accident coverages

Perfect Rider Plus

Enhance your motor insurance and get extra protection with personal accident coverage.

Terms and conditions apply.

- Applicable to all eligible non-motor policies transacted during the Campaign Period, including new and renewal businesses that meet the customer eligibility.

- The customer is responsible for providing a valid and accurate mobile number and full contact details during the purchase or renewal of motor insurance plan to be eligible for the Campaign. The same mobile number must valid and active during the fulfilment of the Campaign. Should the customer change the mobile number during the fulfilment of the Campaign, the customer shall not be entitled to the reward.

- Campaign reward exclusions:

- This Campaign rewards are not applicable for motor casers with full and/or partial premium rebate/discount offered;

- The same vehicle which is being rewarded by another concurrent customer Campaign organised by Liberty and AmBank during the Campaign Period;

- Any cancellation, endorsement performed or policy reinstatement of the motor insurance plan during the Campaign Period will not be eligible for the BonusLink Points.

- Customers who complete their purchases through AmOnline will, by default, receive their rewards in the form of cash.

- In instances where a customer is redirected from the BonusLink App to AmOnline, the reward will be issued as BonusLink Points.

- Customers making purchases at physical branches are given the option to select their preferred reward method – either BonusLink Points or cash. Should no selection be made at the time of purchase, the reward method shall default to cash.

- Cash rewards shall be credited to the customer’s AmBank Current or Savings Account (CASA). Customers must hold a valid CASA account at the time of reward fulfilment to be eligible for cash crediting.

- Non-Motor Insurance is underwritten by Liberty General Insurance Berhad.

- The Bank reserves the right to replace the reward with another reward as and when circumstances dictate.

- The Bank reserves the right to alter, amend or change any of the terms and conditions (including the rewards and criteria) as it deems t at any time with written notice to customers of 30 calendar days prior to the changes taking effect via AmBank website and AmOnline App.

- For the full terms and conditions, please visit ambank.com.my/SafeNSave

Need to renew your motor insurance too?

You could get back up to 10% rebate of your premium in BonusLink Points when you purchase or renew your motor insurance policy with us. Learn more here.