Get started easily with AmOnline

Opening an account/-i via AmOnline App only takes you a few minutes.

Start with downloading AmOnline.

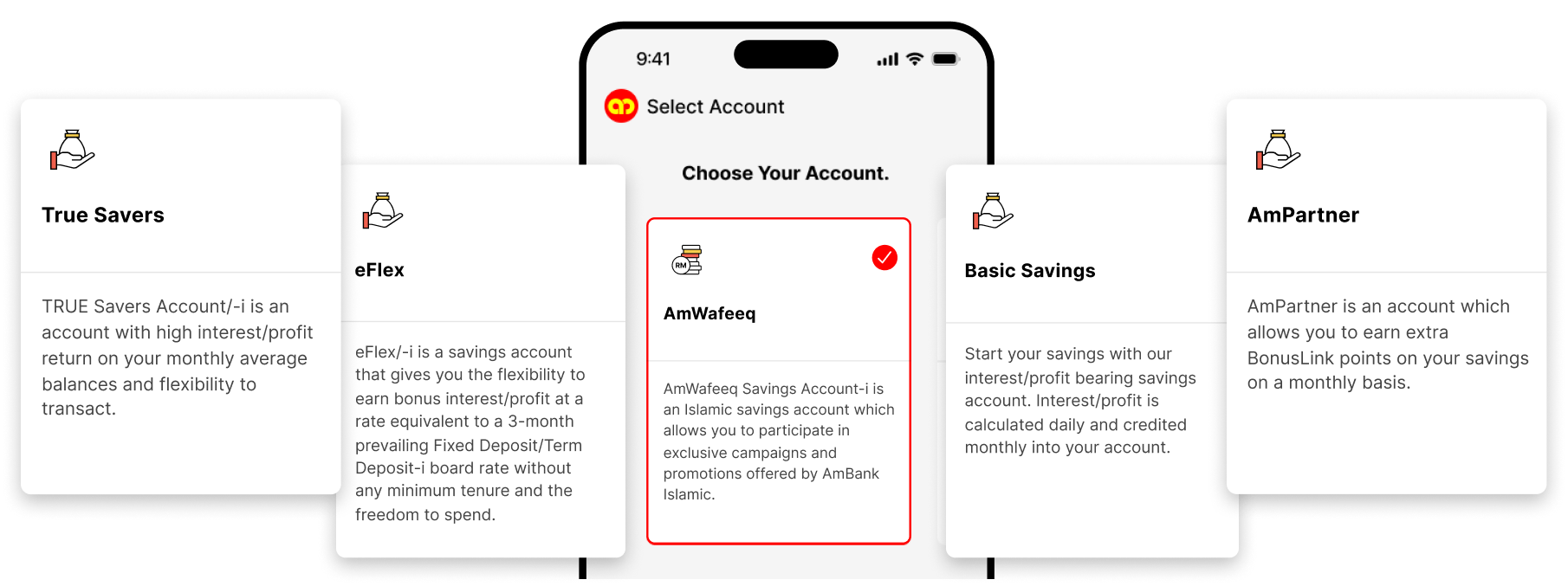

Choose from 5 Savings Account types

Kick-start your savings with our range of Conventional and Islamic accounts. Take charge of your finances today - discover more about our savings accounts here.

Complete in minutes.

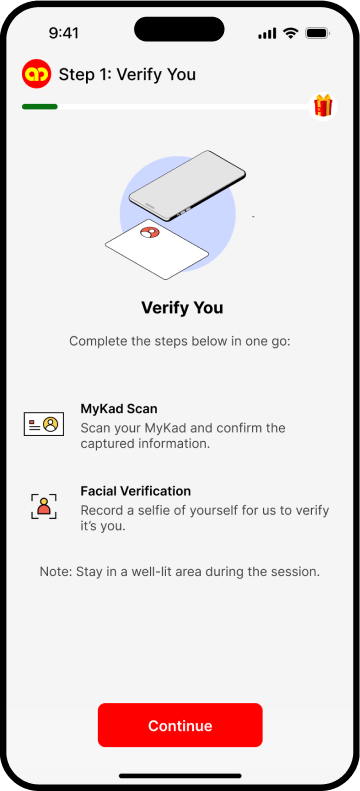

STEP 1

Verify You

Complete MyKad scan and Selfie Verification

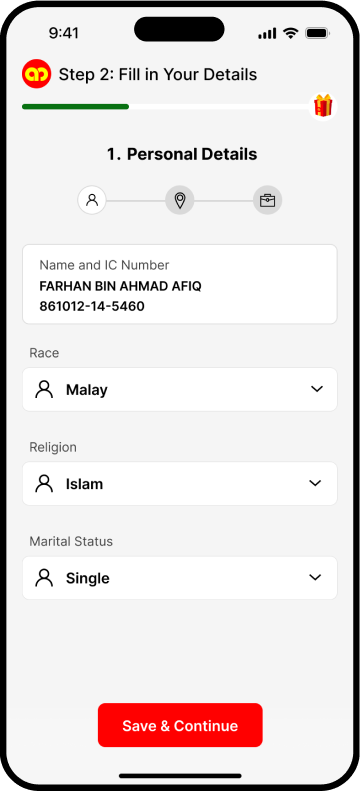

STEP 2

Fill in Your Details

Key in your personal and employment details.

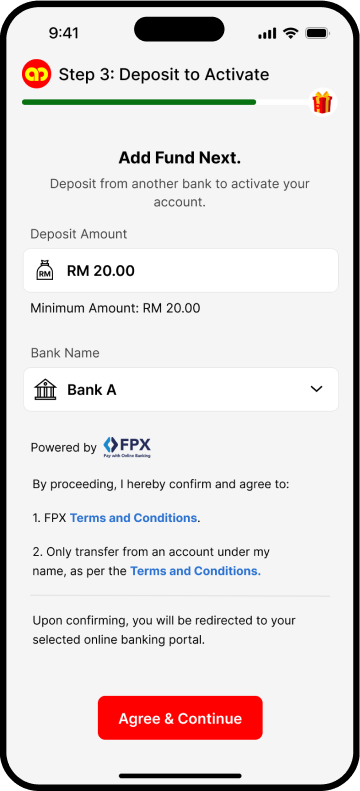

STEP 3

Deposit to Activate

Fund minimum RM20 into your new account from another bank.

STEP 4

Create Your Profile

Create Username and Password to manage your account.

Questions on AmOnline?

Check out our banking features or read our FAQ on opening accounts via AmOnline.

Download AmOnline App today